THE FUTURE OF DECENTRALIZED FINANCE (Defi) AND THE POTENTIAL IMPACT ON TRADITIONAL FINANCIAL SYSTEMS AND THE GLOBAL ECONOMY

Table of contents

- INTRODUCTION:

- PREREQUISITES:

- DECENTRALIZED FINANCE (DeFi)

- IMPACTS DEFI HAS ON TRADITIONAL FINANCIAL SYSTEMS

- Systemic disruption of traditional borrowing and lending:

- Utilization of smart contracts to make financial transactions without the need for a central authority possible:

- Automation of processes to improve accessibility and effectiveness in financial services:

- Providing access to financial services and empowering underbanked communities:

- The decentralized insurance policies offered by smart contracts will revolutionize the insurance market:

- Enhanced security and transparency in financial transactions thanks to DeFi's decentralized structure:

- Introducing decentralized exchanges as a replacement for conventional centralized exchanges (DEXs):

- Financial innovation and the development of new financial services and products are made possible by decentralized finance:

- Everyone is welcome in the DeFi ecosystem, regardless of their location or financial situation, which may promote greater financial inclusion and financial democratization:

- DeFi can provide greater flexibility and control over one's own money in addition to higher investment returns than conventional financial solutions:

- DeFi can make it possible to establish new markets and financial products, such as derivatives and prediction markets, which are not feasible in traditional finance:

- DeFi can open up new avenues for financial innovation, such as the creation of brand-new blockchain-based technology and financial services-improving algorithms.

- Decentralized finance has the ability to generate new jobs and business possibilities in the financial and technology industries:

- CONCLUSION:

- AUTHOR:

INTRODUCTION:

"Are you prepared for the uprising? Decentralized Finance, often known as DeFi, is revolutionizing the established financial system through its creative application of blockchain and smart contract technologies. DeFi is revolutionizing the market with its trust, freedom, and transparency in everything from lending and borrowing to trading and insurance. Come along as we explore how DeFi is upending the status quo and generating fresh possibilities for global financial inclusion."

PREREQUISITES:

It's crucial to have a fundamental understanding of blockchain technology and cryptocurrencies as a novice to the field of decentralized finance (DeFi). Despite being a young field, DeFi is built on the principles of blockchain and digital assets. Understanding the fundamentals of how blockchain and cryptocurrencies operate will provide you a strong basis for exploring the world of DeFi. As DeFi is frequently contrasted with conventional financial systems, it is also crucial to have a basic understanding of traditional finance and financial markets.

It's also critical to recognize that DeFi is a highly technical and intricate topic, and that without a firm understanding of the underlying technology, it can be challenging to comprehend all of its complexities. As a result, it's crucial to approach learning about DeFi with an open mind and a desire to delve into the technical specifics.

Nevertheless, it's critical to keep in mind that the field of DeFi is rapidly expanding, with new initiatives and advancements appearing frequently. As a result, it's vital to keep up with the most recent information and trends in the DeFi industry by following pertinent blogs, forums, and social media accounts.

The materials and information offered in the post will be easier for you to grasp and utilize if you keep this in mind.

DECENTRALIZED FINANCE (DeFi)

Imagine a world where you could earn interest on your own money without needing to pay it to a bank in order to borrow money. DeFi's main focus is on that. It's a brand-new method of handling finances that makes use of the blockchain. The blockchain functions as a giant digital ledger that records all financial transactions that take place in this brand-new DeFi universe.

Furthermore, because it is digital, anyone with access to the internet can use it, even you! Systems like Uniswap, Ubeswap, Moola Market, and others are examples of DeFi. In order to borrow money or lend it to others, you can utilize a device known as a smart contract rather than going to a bank. Furthermore, everything is fair because it's all on the blockchain. You can exchange various digital currencies, such as Bitcoin or Ethereum, directly in this new world of DeFi without the use of an intermediary. Additionally, just like with actual money, you may get insurance to safeguard your digital funds.

DeFi is a brand-new approach to manage money that will forever revolutionize the way we think about finance, even though it may seem a little complicated now. As you get older and understand more about technology and finance, you'll see what I mean.

Decentralized applications (dApps) that offer financial services including lending, borrowing, trading, and insurance are available through the DeFi ecosystem, which is based on the Ethereum blockchain. These dApps automate the process through the use of smart contracts, enhancing the procedure's usability and effectiveness for users. Lending and borrowing services, which enable users to lend and borrow cryptocurrencies in a decentralized way without the need for a central authority to approve loans, are among the most well-known DeFi applications.

Decentralized exchanges (DEXs), which let users trade cryptocurrencies without the need for a central authority, are another well-known DeFi application. DEXs give consumers the option to trade directly from their own wallets, which offers a higher level of security and financial control than centralized exchanges. By providing decentralized insurance platforms that employ smart contracts to streamline the process and give coverage for risks that are generally not covered by traditional insurance firms, DeFi also has the potential to transform the insurance sector.

Decentralization of DeFi offers a chance for financial inclusion, especially for underbanked people. The World Bank estimates that 1.7 billion individuals worldwide lack access to conventional financial services. DeFi can give these people access to financial services, enhancing their financial situation.

It's crucial to remember that the DeFi sector is still relatively young and fast developing. Before investing in any DeFi projects, users must fully grasp the risks involved and undertake extensive research. Growing pains and difficulties must be addressed, like with any new technology. But as I'll discuss below, the potential advantages of DeFi are too great to overlook. It's time to get involved in the decentralized finance revolution, which has already started.

IMPACTS DEFI HAS ON TRADITIONAL FINANCIAL SYSTEMS

Systemic disruption of traditional borrowing and lending:

A financial system called decentralized finance (DeFi) is based on blockchain technology and enables the development of decentralized, peer-to-peer financial applications and services. The disruption of conventional lending and borrowing systems by the usage of decentralized lending and borrowing platforms is one of the main effects of DeFi on conventional financial systems. These platforms automate the loan and borrowing process using smart contracts, making financial services more available and effective for a larger range of consumers, including individuals who could be underbanked or unbanked.

DeFi lending and borrowing platforms can significantly lower the cost and complexity of these financial services by using blockchain technology to do away with the need for middlemen like banks.

Utilization of smart contracts to make financial transactions without the need for a central authority possible:

DeFi uses blockchain-based smart contracts to do away with the necessity for a central authority in financial transactions. Smart contracts enable for automatic implementation and enforcement of the conditions without the need for intermediaries because the terms of the agreement are encoded directly into the code. As a result, there is no longer a need for a centralized body to supervise and validate financial transactions, which decentralizes and undermines trust in the system.

Automation of processes to improve accessibility and effectiveness in financial services:

DeFi makes financial services more accessible and efficient by automating operations through the use of blockchain technology and smart contracts. Processes like lending, borrowing, and trading may be automated with smart contracts, which makes them quicker, less expensive, and more effective. This may increase the accessibility of financial services for a broader spectrum of users, including individuals who might not otherwise have access to them. Additionally, by eliminating the need for middlemen, automation of these operations increases efficiency and lowers costs.

Providing access to financial services and empowering underbanked communities:

DeFi gives underbanked people access to financial services, thereby empowering them. DeFi's decentralized and distrustless structure enables the development of financial services that anyone with an internet connection, regardless of geography or financial background, can use. By allowing them access to services like lending and borrowing that they might not have otherwise had, this can help close the gap between the underbanked and regular financial systems. The fact that DeFi platforms sometimes have lower entry hurdles than conventional financial systems can help underbanked communities access these platforms more easily.

The decentralized insurance policies offered by smart contracts will revolutionize the insurance market:

DeFi transforms the insurance sector by offering decentralized insurance contracts that are controlled by smart contracts. Decentralized insurance policies can be created using smart contracts, and they can be purchased and carried out without the aid of middlemen like insurance firms. This can significantly lower the price and complexity of insurance policies, hence increasing their accessibility and affordability to a larger variety of consumers.

Smart contracts can automate insurance plans, which can boost efficiency further by allowing claims to be processed and paid out electronically, doing away with the need for manual claim processing. This may make it possible to serve policyholders more quickly and effectively.

Enhanced security and transparency in financial transactions thanks to DeFi's decentralized structure:

By utilizing blockchain technology, decentralized finance (DeFi) has the potential to improve the security and transparency of financial transactions. As transactions are recorded on a decentralized ledger that cannot be altered, this can boost public confidence in the financial system. DeFi can also lessen the danger of financial crimes like fraud or money laundering because it is more difficult for criminals to work secretly or cover up their operations due to the transparency of blockchain transactions.

Introducing decentralized exchanges as a replacement for conventional centralized exchanges (DEXs):

By leveraging decentralized exchanges (DEXs) instead of centralized financial institutions, decentralized finance (DeFi) offers an alternative. These DEXs, which are based on blockchain technology, enable asset trading between peers without the need for a central broker. As a result, more people and organizations who might not have been able to access financial services through conventional financial systems may now have greater access to them. This can also assist to promote transparency and security in financial transactions. DEXs can also aid in lowering the danger of fraud and hacking that exists in centralized exchanges.

Financial innovation and the development of new financial services and products are made possible by decentralized finance:

Through the use of blockchain technology to develop new financial goods and services, decentralized finance (DeFi) offers a chance for financial innovation. Decentralized applications (dApps) and smart contracts can be developed using DeFi and used to produce and provide a variety of financial services, including lending, borrowing, trading, and insurance. DeFi can therefore create previously impractical new financial products and provide people and organizations with new avenues for accessing financial services.

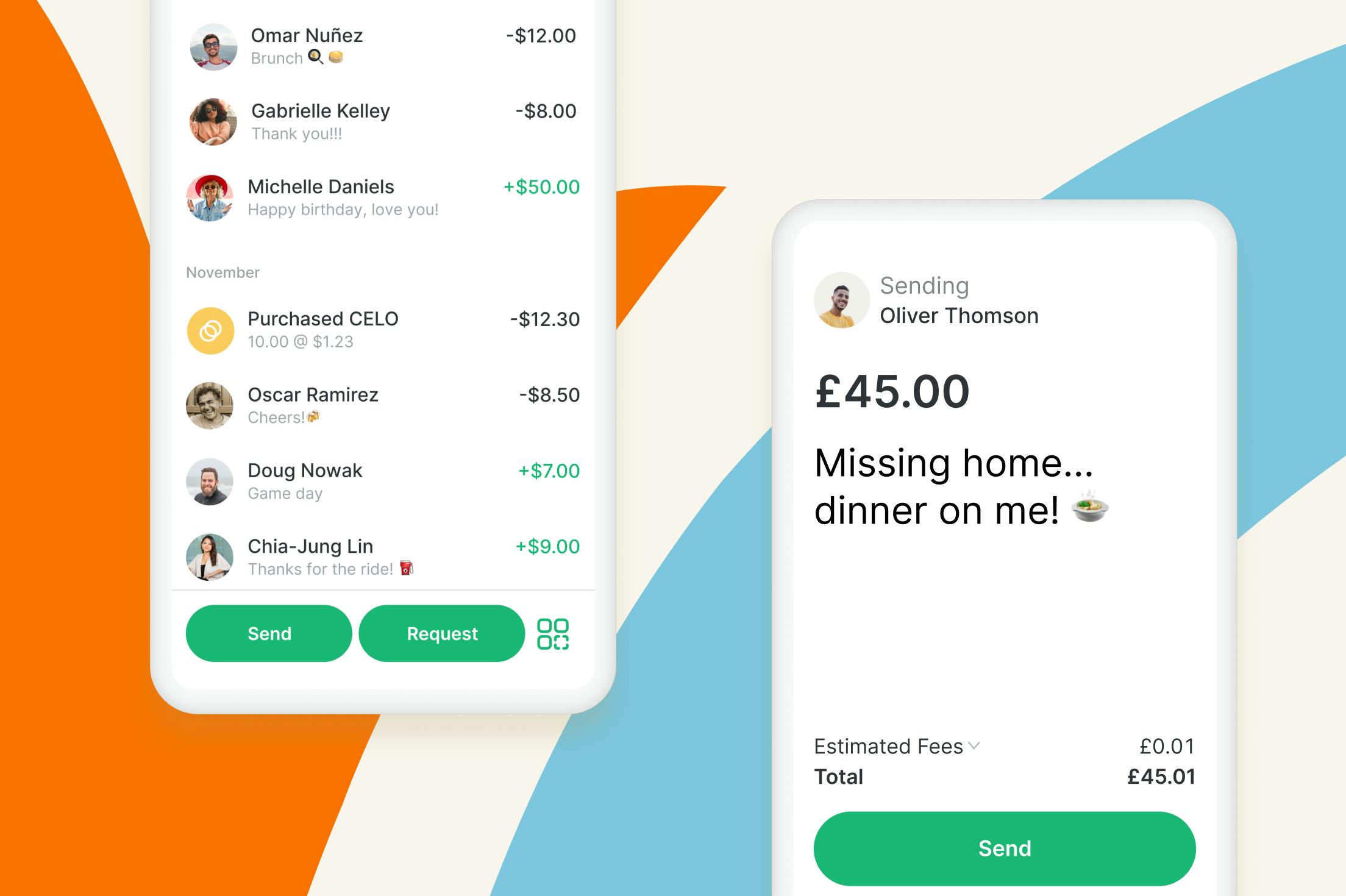

DeFi can also offer a more effective and affordable way to receive financial services because it does away with the need for intermediaries and lowers the costs related to traditional financial services. Example:[Valora App] ( https://valoraapp.com/)

Everyone is welcome in the DeFi ecosystem, regardless of their location or financial situation, which may promote greater financial inclusion and financial democratization:

Decentralized finance (DeFi) offers an open environment that is accessible to everyone, regardless of geography or financial situation, which can promote greater financial inclusion and democratize the financial system. DeFi enables the development of decentralized applications (dApps) and smart contracts that are accessible to anybody with an internet connection because it is based on blockchain technology. As a result, people and businesses in underbanked or unbanked locations, as well as those who lack access to conventional financial services, can nevertheless take part in the DeFi ecosystem.

DeFi can also make it easier and more accessible for people and organizations to obtain financial services because it does away with the need for middlemen and lowers the entry barriers that come with conventional financial systems.

DeFi can provide greater flexibility and control over one's own money in addition to higher investment returns than conventional financial solutions:

Decentralized finance (DeFi), which gives investors access to a greater variety of investment choices and makes use of the capabilities of blockchain technology, can provide higher returns on investments than conventional financial products. Decentralized applications (dApps) and smart contracts can be developed using the DeFi ecosystem to provide a variety of financial services, including lending, borrowing, trading, and insurance, which can yield higher returns than conventional financial goods.

DeFi also gives users more flexibility and control over their own money because transactions are tracked on the blockchain and consumers have direct authority over their money rather than third parties like banks. More openness, security, and independence in handling one's own money are possible as a result.

DeFi can make it possible to establish new markets and financial products, such as derivatives and prediction markets, which are not feasible in traditional finance:

By utilizing the capabilities of blockchain technology, decentralized finance (DeFi) can enable the creation of new financial products and markets that are not feasible in traditional finance.

Smart contracts that can be used to build new kinds of financial instruments, like derivatives and prediction markets, can be created using DeFi. These financial tools can be used to manage volatility in the cryptocurrency markets and hedge against risk.

DeFi can also enable the development of fresh markets where customers may wager on the results of upcoming events, like prediction markets. These new financial markets and instruments may open up new avenues for people and businesses to obtain financial services, as well as contribute to greater security and transparency in financial dealings.

DeFi can open up new avenues for financial innovation, such as the creation of brand-new blockchain-based technology and financial services-improving algorithms.

Blockchain technology, which enables the development of new technologies and algorithms to improve financial services, can be used to support decentralized financing (DeFi), which can open up new potential for financial innovation. DeFi, for instance, can make use of smart contracts, which can be programmed to carry out financial operations like lending and borrowing automatically and without the aid of mediators.

DeFi can also leverage blockchain-based technologies like stablecoins to develop digital currencies that are more reliable, as well as decentralized autonomous organizations (DAOs) to control financial services and products.

By enhancing the effectiveness and security of financial services, these new technologies and algorithms can give people and organizations additional options to use financial services. DeFi also encourages the development of fresh business models like yield farming that provide users new opportunities to profit from their assets.

Decentralized finance has the ability to generate new jobs and business possibilities in the financial and technology industries:

Decentralized finance (DeFi), which offers a new platform for the creation and implementation of financial services, has the potential to generate new employment possibilities in the technology and finance industries. DeFi needs a professional workforce to create, implement, and maintain the decentralized applications and smart contracts because it is based on blockchain technology. Software developers, blockchain engineers, and other professionals in similar fields may find new employment prospects as a result in the technology sector.

DeFi also has the potential to open up new job opportunities in the finance industry, including risk management, financial modeling, and other related positions, as it is a relatively new and emerging profession. These new positions and possibilities could promote development and expansion in the financial and technology industries as well as broaden people's access to financial services.

CONCLUSION:

In conclusion, DeFi has the potential to severely disrupt the established financial system by offering fresh, cutting-edge methods for transacting money in an open, honest, and transparent manner. It can liberate underbanked groups, democratize finance, and open up fresh doors for financial innovation and expansion. Before investing in any DeFi ventures, it is crucial to be aware of the hazards as with any new technology and to undertake careful study.

AUTHOR:

Maxwell Onyeka is a solutions-focused, meticulous, strategy- and results-driven manager with more than five years' experience building paid and organic marketing funnels for SaaS companies. I'm well-versed in the major social media networks, including Facebook, LinkedIn, Twitter, and Instagram. My great communication abilities enable me to create engaging tweets and blogs that increase traffic and user interaction.